Select country

South Africa

South Africa Lesotho

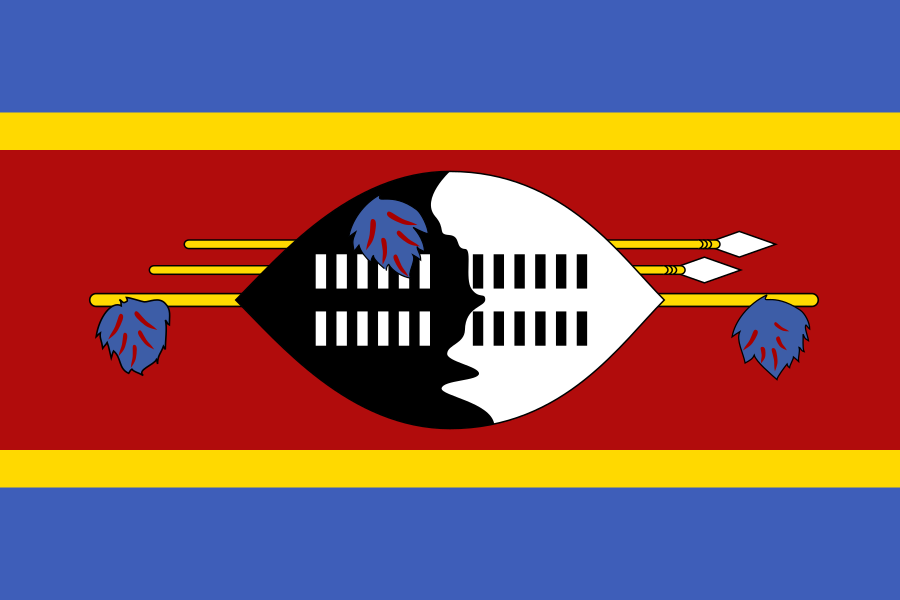

Lesotho Swaziland

Swaziland Namibia

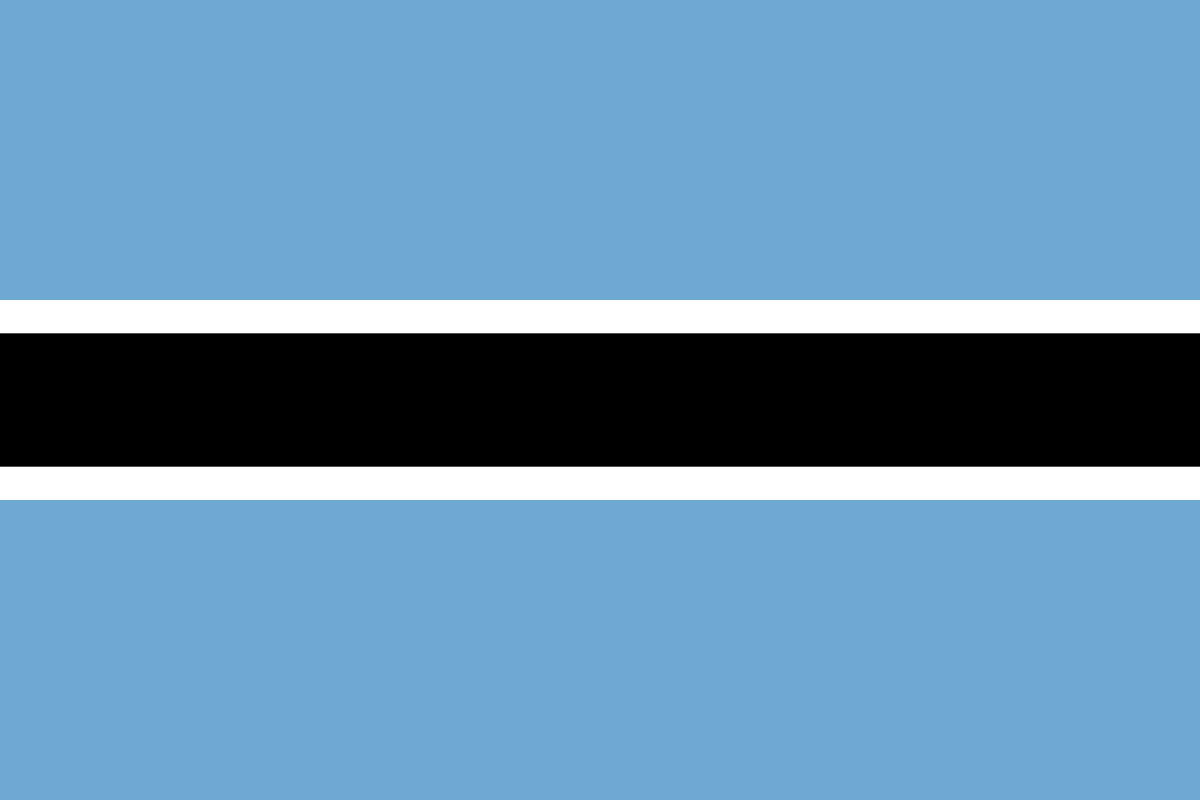

Namibia Botswana

BotswanaGetting our service right is important to us. If you have any questions, compliments or complaints, please let one of our experienced service agents help you. You can contact us in any one of the following ways:

When you buy something from us, we want you to be completely comfortable with your purchase, and understand the terms. Our advertised instalment includes all costs.

That's why at Lewis Stores:

When you buy at Lewis Stores, you can be sure you re buying the highest quality. We believe in our products so much that everything you buy carries a guarantee specific to the product.

Ask your salesperson about the guarantee on your product. We also offer extended warranties on merchandise to give you further peace of mind, after the manufacturers guarantee has expired.

Buying new furniture for your home is exciting and a big financial decision. At Lewis Stores you can buy with complete peace of mind, as we offer you a range of insurance products that will protect not only you, but your new furniture or appliance too.

We require you to have credit life insurance and goods cover while there is money owing on your account. You do not have to choose the insurance products we offer in store. If you prefer to provide your own insurance cover, it must meet the standard requirements as allowed for by Regulations.

The insurance products offered by Lewis on behalf of Monarch Insurance Company, a subsidiary of Lewis, are tailored to suite your needs and consist of the following benefits:

| Standard Credit life insurance benefits. | Optional Top-up Credit life insurance benefits. |

| DEATH insurance | |

| In the event of the account holder's death, the outstanding balance will be settled in full. | |

| PERMANENT DISABILITY insurance | |

| In the event of the account holder's permanent disability, the outstanding balance will be settled in full. | |

| TEMPORARY DISABILITY insurance - Instalments due | TEMPORARY DISABILITY insurance - Outstanding balance |

| In the event of the account holder's temporary disability, the instalment will be paid for in a defined period (a maximum of 12 months). | In the event of the account holder's temporary disability, the outstanding balance will be settled in full. (Enhanced benefit that settles the full balance) |

| LOSS OF INCOME Insurance - Instalments due | LOSS OF INCOME insurance - Outstanding balance |

| In the event of the account holder’s loss of full-time employment, the instalment will be paid for a defined period (a maximum of 12 months). | In the event of the account holder's loss of full-time employment, the outstanding balance will be settled in full. (Enhanced benefit that settles the full balance) |

| Standard Credit life insurance benefits. | Optional Top-up Credit life insurance benefits. |

| DEATH insurance | |

| In the event of the account holder's death, the outstanding balance will be settled in full. | |

| PERMANENT DISABILITY insurance | |

| In the event of the account holder's permanent disability, the outstanding balance will be settled in full. | |

| TEMPORARY DISABILITY insurance - Instalments due | TEMPORARY DISABILITY insurance - Outstanding balance |

| In the event of the account holder's temporary disability, the instalment will be paid for in a defined period (a maximum of 12 months). | In the event of the account holder's temporary disability, the outstanding balance will be settled in full. (Enhanced benefit that settles the full balance) |

| LOSS OF INCOME Insurance - Instalments due | LOSS OF INCOME insurance - Outstanding balance |

| In the event of the account holder’s loss of full-time employment, the instalment will be paid for a defined period (a maximum of 12 months). | In the event of the account holder's loss of full-time employment, the outstanding balance will be settled in full. (Enhanced benefit that settles the full balance) |

| Standard Material Damage insurance benefits: | Optional Top-up Material Damage insurance benefits: |

| Should your goods be accidently damaged or destroyed or stolen, we will settle the outstanding balance. | Should your goods be accidently damaged or destroyed or stolen, you can choose whether we settle the outstanding balance or replace the goods. (Enhanced benefit that offers you a choice) |

Terms and conditions (including limitations and exclusions on cover) apply to all insurance product options. The product options available vary depending on your employment status. For more information, ask for a brochure at your nearest Lewis Stores store or phone the toll-free Insurance Call Centre on 0800 000 598.

Where you are an existing customer and Monarch policyholder please contact our Insurance Call Centre on 0800 000 598 should you wish to claim or submit a complaint.

You have the right to choose whether you wish to select, or not select any of Monarch s insurance products, listed above. In addition, you also have the right to choose any of the following products offered by Lewis Stores:

You also have the right delay the signing of an agreement by 5 (five) days to consider the proposed agreement. If you are dissatisfied with your purchase you have 5 (five) business days from the date of invoice to cancel the contract and to request a refund.

For any queries or complaints please phone our call centre on 0800 228 444